John Stuart Mill observed long ago that profits are the remuneration of abstinence. So basic and so crucially true. Contra the droolings of economists and their enablers in the media, consumption doesn’t drive economic growth. What powers progress is unspent wealth. When it’s matched with talent, productivity soars.

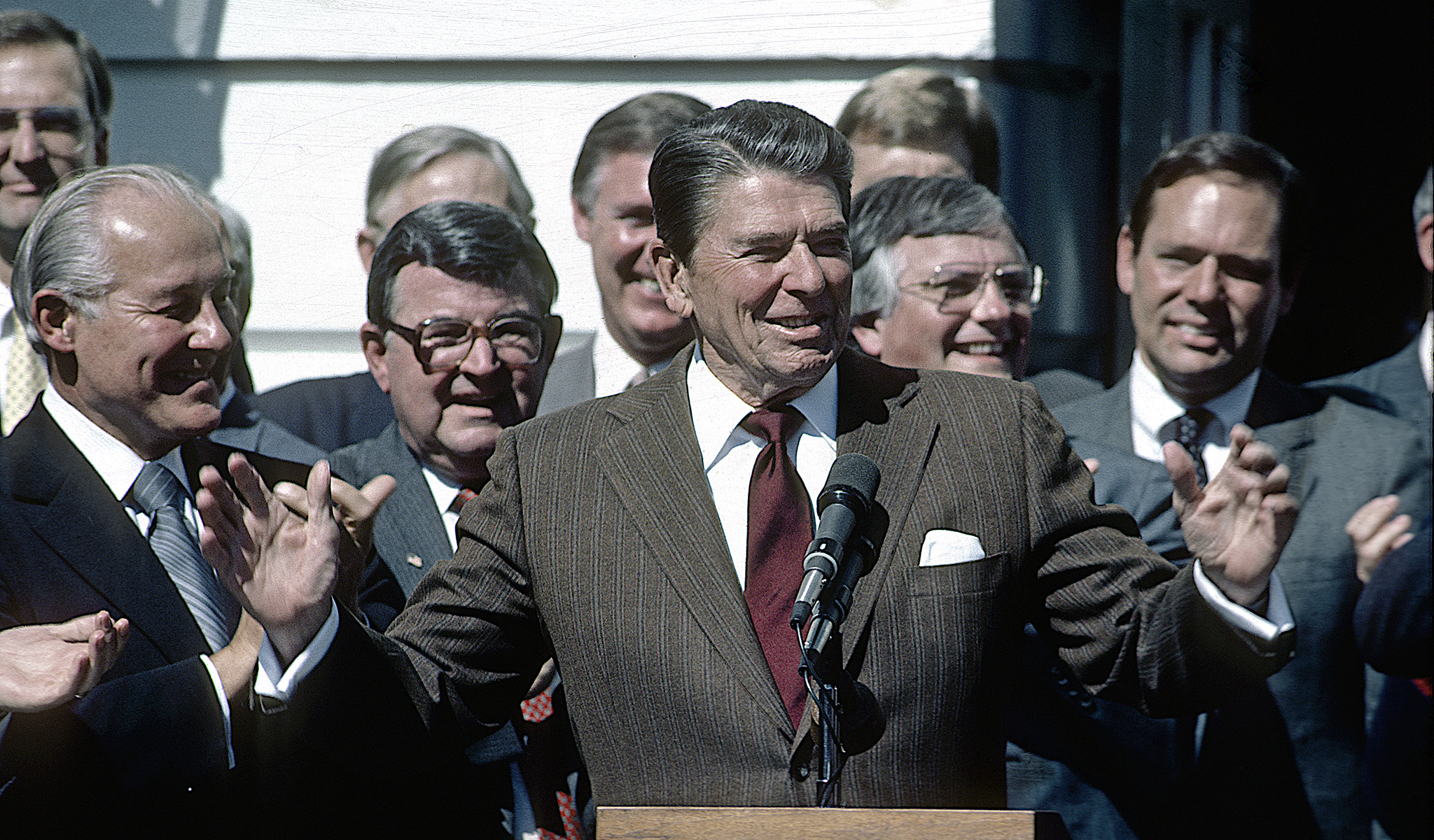

The rich, by virtue of being rich, have unspent wealth in gargantuan amounts. Which is why any tax thinking rooted in lifting innovation and economic growth should be all about reducing the tax burden on the rich in any way possible. When the rich are taxed less, there’s much more progress along with opportunity for those who aren’t rich.

These basic truths are increasingly lost on those on the right. They go out of their way to showcase their anti-rich bona fides. In a recent opinion piece, Mercatus Center’s Veronique de Rugy criticized the Democrats for working “nonstop to ease the tax burden of their high-income constituents.” This doesn’t sound like her. And if the Dems are doing as she says, they’re promoting pro-growth, pro-freedom tax policy. The rich have the capital (growth), plus when they’re taxed less we’re freer. And then there’s Washington Examiner columnist Tim Carney.

He recently wrote that uncapping the State and Local Tax Deduction (SALT) would “exacerbate budget deficits and inflation while almost solely helping high income people.” There’s little truth in those twelve words. Think about it.

First is the deficits. Carney errs in the way that so many do on the Left and Right in imagining that government debt springs from too little revenue. Better to think about this differently. High incoming and the expectation of much higher incoming in the future is what enables debt, whether for individuals, businesses, or governments. This is so basic that it feels like words are being wasted in stating it, but it will be stated. The U.S. has big deficits and massive amounts of debt not because it takes in too little tax revenue, but precisely because it takes in way too much. To believe as Carney does is to believe that markets are incredibly stupid.

Carney claims deficits cause inflation. Backwards. And for obvious reasons. In a simple theoretical sense, let’s never forget that when investors purchase government debt, they’re purchasing future income streams. If debt caused inflation, investors would be buying incomes streams rapidly declining in value. Not likely. Only in movies is money dumb. Moving to the empirical, in 1980 the U.S. had $900 billion in total debt, and the 10-Year Treasury yielded 11 percent. Over the next 40 years the U.S. ran up trillions and trillions more debt in concert with mostly declining inflation. Even in 2023 amid soaring 10-Year yields, they’re still 600 basis points lower than they were amid exponentially less debt. There’s no debt/inflation correlation.

As for Carney’s line about an uncapped SALT helping rich people, what lowers their tax burden once again lifts the economic chances of those who aren’t rich. There are no companies and no jobs without investment first, and the rich have the funds to invest.

What Carney also leaves out is that when the rich are paying fewer taxes, they subsidize us by handing over less to Treasury. This is a very basic truth, albeit one lost on the pundit and economic class. Focused on deficits and debt, they ignore that the true horror of government isn’t in how the wealth is extracted (taxes or borrowing), but in the extraction itself. This is worth thinking about.

Having done so, don’t forget that when we (and the rich in particular) get to hold on to our wealth, precious resources are directed to their highest use in market-driven fashion. Conversely, when government extracts resources whether through taxes or borrowing, precious resources are directed in politicized fashion by politicians whose allocations wholly ignore the wishes of the marketplace. In other words, government spending is the embodiment of the very central planning of resources that fails, always and everywhere. Which is why we should cheer the rich for lowering their tax bills: when they do the latter, we suffer less in the way of central planning.

Bringing it back to the Republicans and the right, the rich get that way by doing remarkable things that make the U.S. the envy of the world. The rich are brilliant. Why would Republicans and the right run from what has lifted them for so long? The Party of the Rich. That’s a cool thing to be.