Nowadays the vast majority of companies that defined the internet boom of the late 20th/early 21st century are gone, but not the fruits of this powerful jump into a better future. The internet defines life as we know it for the much better, and it does precisely because government didn’t step in to prop up the thousands of mediocre to bad businesses that went under in and around 2001.

It’s something to think about as U.S. economic pundits start to write post-mortems on China’s economy, while making their cases that “a China-dominated world is even less likely than it ever was.” The words in quotes are from an editorial published at the Washington Post about China’s “tanking economy.” One guesses that similar pieces were written by foreign and domestic editorialists back in 2001 about the U.S. Which is why economics writing can be a bit of an ass.

For one, consider what actual U.S. businesses are presently doing in China. Global symbol of Americana McDonald’s Corp. recently announced plans to nearly double its China store count to 10,000 by 2028. As of 2020 there were 4,100 Starbucks stores in China. There are over 6,000 now. So advanced is AI technology in China that the Biden administration has (shamefully) resorted to naively imposing export bans on companies like Nvidia, Intel, and AMD as a way of limiting technology sales that “could fuel breakthroughs in artificial intelligence and sophisticated computers” in China, and that would logically (and happily) make their way here. It seems those in the proverbial arena are expanding in China based on a vision not shared by economists and editorialists.

The Post editorial notes about China, that “more than 50 major developers are either out of cash or have defaulted. Fears abound of insolvencies leaving millions of unfinished housing projects.” Bad news? Not really. Better yet, no one’s dying. Bankruptcy or failure won’t cause the employees of the companies or the work done by those companies so far to vanish as much as the former employees and unfinished work will be bid for on the relative cheap by others. As for the debts that will go unpaid, the world is awash in investment funds that will purchase the defaulted Chinese debt in intrepid fashion, and in certain cases billionaires will be minted for entering the proverbial burning house. Which is where it gets strange.

Rather than calling for government to get out of the way so that Chinese markets can clear in healthy fashion, the Post’s editorial board argues that “The government could take over unfinished properties to ensure their completion and to guarantee the prepayments of prospective buyers.” The latter is the modern equivalent of U.S. politicians stepping in to save theglobe.com, eToys.com, and NetZero from bankruptcy and obsolescence following the aforementioned internet boom.

Next, the Post asserts that as a way to “deal with its aging population, China could also widen its meager social safety net.” Has Social Security been that effective, or cost-effective here? The same editorial asserts that a safety net “could help the economy; people save rather than spend because of the lack of government support.” This one is wrong twice. For one, governments don’t pluck yuan and dollars from the sky to hand out, rather they get them from others. To increase demand from one pocket, they must shrink it from another. Second, economic growth is a consequence of investment, and investment springs from unspent wealth. We all love to consume, but savers are the drivers of growth.

Back to the U.S., but with China’s aging population top of mind, evidence that Americans don’t think much of our own “social safety net” can be found in the massive growth of private sector savings vehicles that more and more Americans do rely on since Social Security pays so little. It’s just a way of saying that if an aging society is at all a problem (as opposed to a bullish signal of people living longer) government isn’t positioned to take care of it.

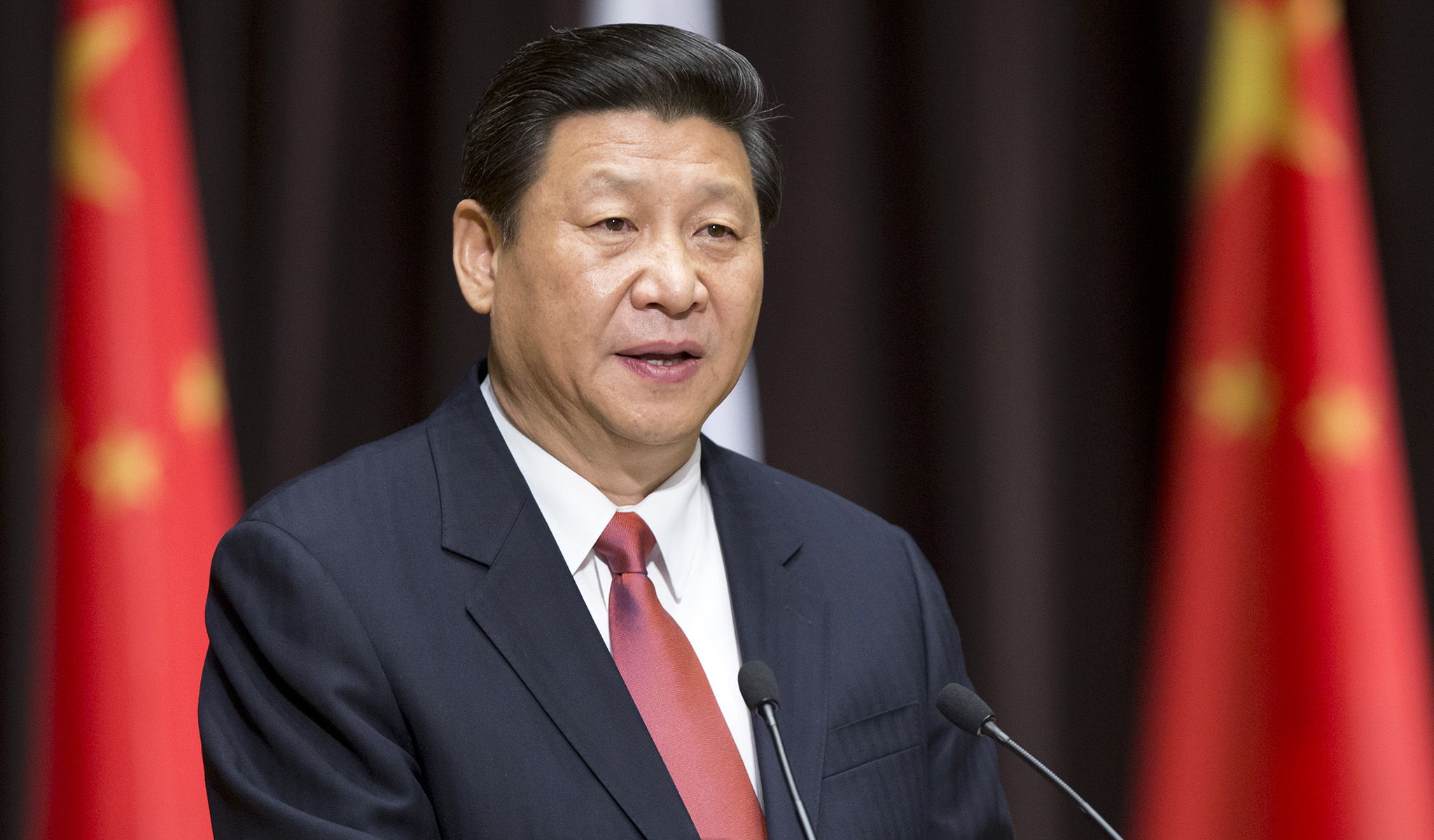

All this said, the Post’s editorial makes good points. It notes that China’s stock market has lost $6 trillion in value. This could be related to Xi Jinping’s less passionate embrace of markets, but then as Post columnist George Will has long pointed out, nothing is forever. Neither is Xi. Furthermore, the decline could alternatively signal a healthy correction that will ultimately feed a healthy recovery as wealth is released from the bad and mediocre to the good and great.

Much more crucially for Americans overall, the editorial points out that “China remains a top U.S. trading partner.” Yes it does. See above. The only closed economy is the world economy, and if China’s economy declines it will be felt here.

Still, for now there’s no evidence that “forever” has arrived in China as evidenced by just how much U.S. companies are betting on a better tomorrow there. As for Xi’s refusal to do much in response to economic troubles in China, the view here is that his do-nothing stance reveals a level of sound economic knowledge that isn’t always evident in his critics. In economics, failure is your friend.

Republished from RealClear Markets