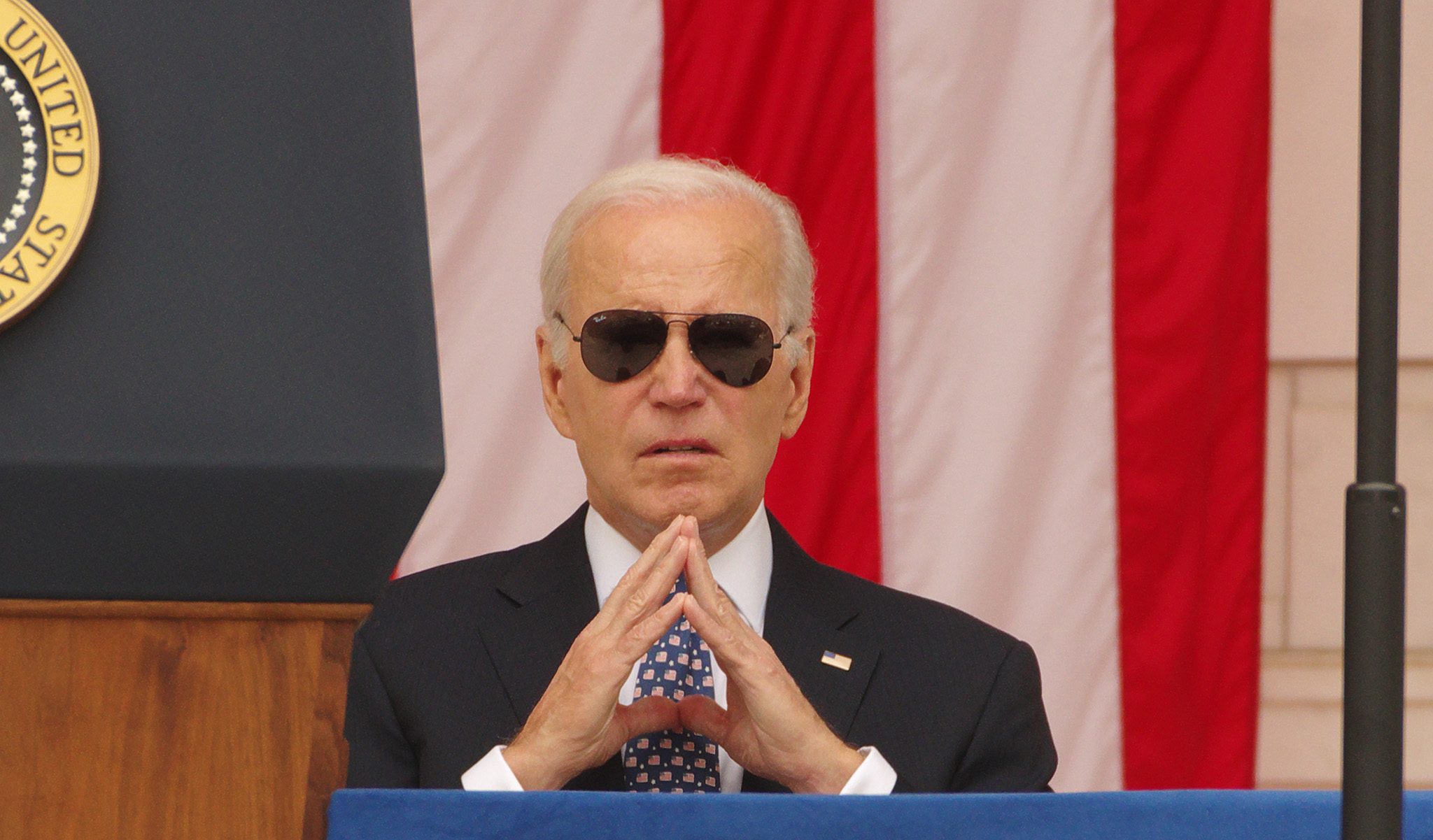

Economics is about tradeoffs. It’s sad something so basic needs to be said, but then we live in an era of Joe Biden opining about inflation.

Opining recently about inflation, Biden presumably read “Let me be clear that any corporation that hasn’t brought their prices back down even as inflation has come down; it’s time to stop the price gouging. Give American consumers a break.”

Oh well, even if corporations were actually more powerful than the market and could set prices, gouging would in no way cause inflation. Think tradeoffs. If you’re being gouged for eggs, internet service, or smartphones, you logically have fewer dollars to purchase other goods. A rising consumer price by definition signals a falling price elsewhere.

University of Michigan professor Justin Wolfers recognizes that Biden’s thinking is “incoherent,” only for him to seemingly err too. In response to Biden he recently wrote that “the only path back to earlier price levels is deflation, which comes with massive economic pain.” Wolfers might agree that the latter isn’t true.

Figure that in a growing economy, falling prices are the rule. Economic growth is just another word for rising productivity, and a growing economy is defined by capital being matched with talent on the way to the production of exponentially more at falling prices.

Notably, Wolfers is based in Michigan, and is no doubt aware of Henry Ford. Ford pledged to create cars for the “great multitude.” Well, yes. That’s how the individuals who comprise what we call an “economy” get rich. In Ford’s case, the price of the Model T fell, and fell, and fell by design. Ford would employ thousands of hands and machines to bring prices down. As opposed to falling prices causing Ford pain, they made him exceedingly rich, and made Detroit a magnet for those seeking a better life born of higher pay.

What was true 100 years ago is true today. The businesses most successful at pushing down prices as a consequence of expertly employing hands and machines the world over, are the most valuable. Apple is the world’s most valuable company precisely because for less than $1,000 it places supercomputers in our pockets that, if the know-how on how to make them had existed 20 years ago, would have cost well into the millions. So no, falling prices aren’t “pain,” they’re generally a sign that the innovative have found ways to democratize access to life’s necessities and luxuries. In the words of Jeff Bezos, “your margin is my opportunity.”

Which brings us to Foundation for Economic Education economist Jon Miltimore. He quotes Wolfers to make a case that Biden is clueless, though Miltimore might agree that he didn’t need Wolfers to make the previous case. See Biden’s comment on “inflation” above if you’re confused.

Still, Miltimore made a few errors on his own. He writes that “inflation is caused by expanding the money supply.” But if the latter were true, the entirety of the U.S.’s existence would have been defined by hyperinflation. Lest Miltimore forget, the so-called “supply” of dollars in circulation soared 163x from 1790 to 1914. As opposed to inflation, surging dollars in circulation were just a sign of economic growth. In reality, actual money in circulation is a reflection of production simply because money’s sole purpose is as a reasonably trusted measure meant to facilitate exchange of actual goods and services.

In which case, surges of money in circulation don’t instigate economic activity or inflation (“printed” or debauched money logically ceases circulation, and against wishes of treasuries or central banks) as monetarists have long assumed, rather they’re a consequence of growth. Conversely, in a shrinking economy circulation of credible exchange mediums logically declines. The main thing is that these aren’t inflationary or deflationary events. During the timeframe mentioned above (1790-1914), there was logically very little inflation simply because the dollar had a gold definition.

To support his inflation case Miltimore quotes Fed officials, but he might agree that relying on the Fed for economic sustenance is like relying on a pastry chef for knowledge of how a carburetor operates. It’s easy to forget that Fed officials almost to a man and woman believe economic growth causes inflation, which tells us how lacking their definitions are.

As always, inflation is a decline in the unit of measure. The only problem is that you can’t deduce the latter by focusing on supply any more than you could judge the inch’s stability by how many foot rulers there are. What matters is the stability of the measure, and that’s rarely mentioned in discussions of inflation, rebuttals of Biden, or both.

Republished from RealClear Markets